Stop reacting to the market. Start anticipating it.

In today's volatile UK power market, success isn't about having more data—it's about achieving clarity, faster. Generic software and manual spreadsheets are too slow, leaving you exposed. We build bespoke power trading software that closes the gap between raw data and high-conviction decisions, giving your desk a durable, analytical edge.

Request a DemoThe New Digital Divide in UK Power Trading

The energy transition has created a paradox: a flood of data has made true insight scarcer. While top-tier firms leverage AI, many desks are trapped in a cycle of manual data exports, spreadsheet errors, and reactive analysis—a critical disadvantage when markets move in 15-minute intervals.

From Hours of Analysis to Speed-to-Insight

GridSight is our web-based intelligence platform for UK power traders. It automates historical analysis and visualises real-time grid status, replacing hours of manual, error-prone spreadsheet work with a clean, intuitive interface. It's designed to give you both a strategic and tactical edge.

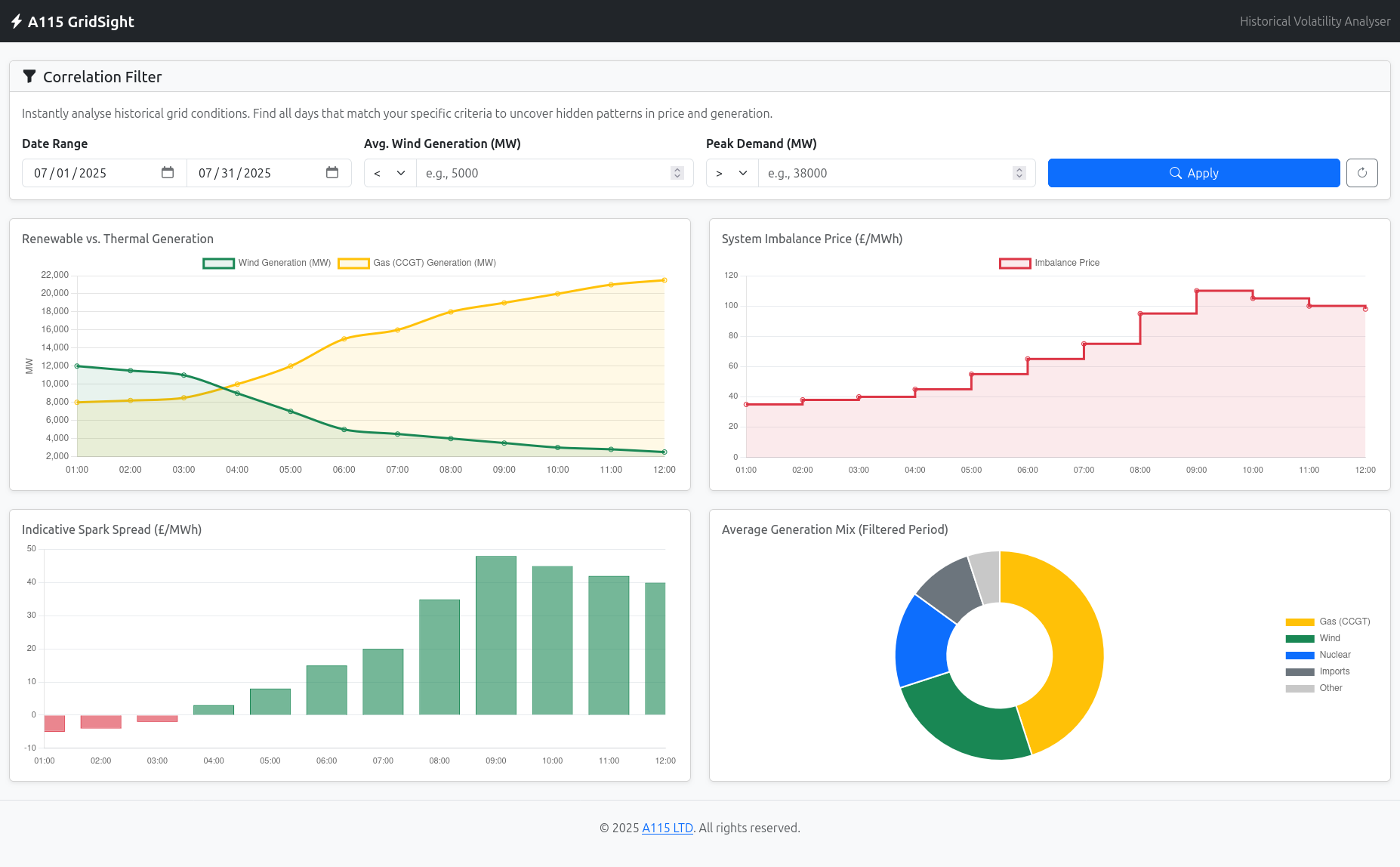

The Strategic View: Historical Analyser

Instantly answer: "What happened to prices the last time grid conditions were exactly like this?" Filter years of data to back-test scenarios in a single click.

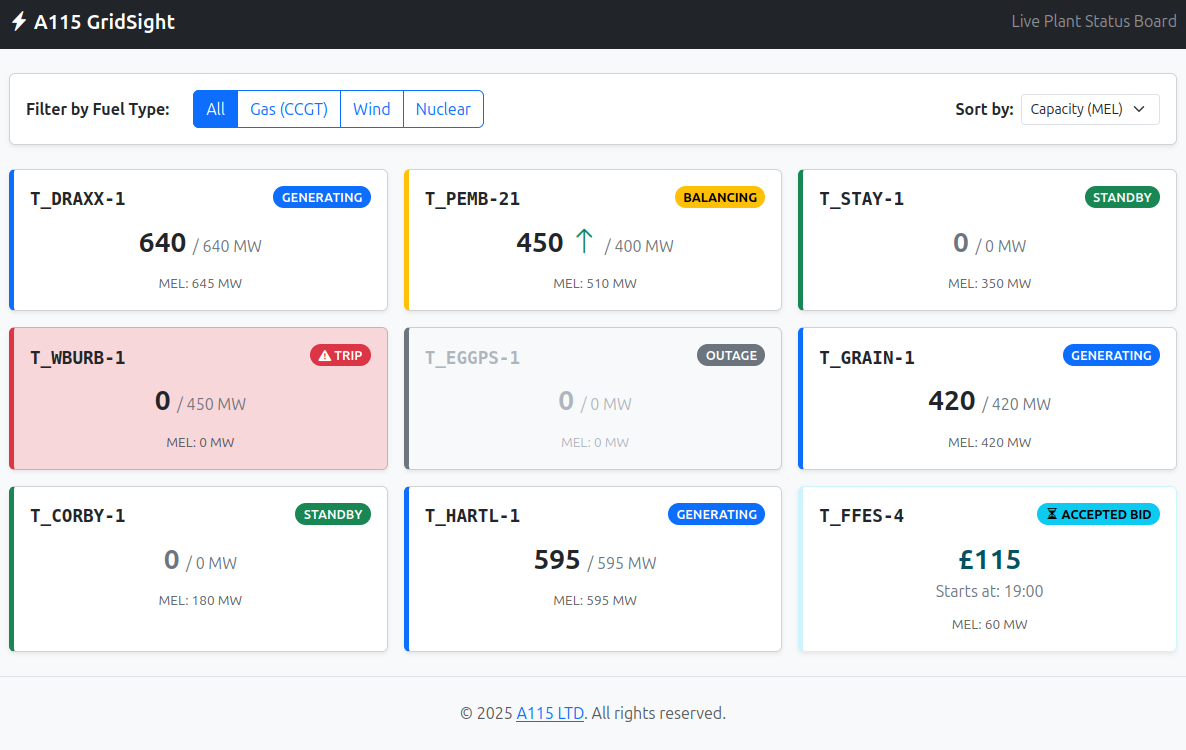

The Tactical View: Live Plant Status

Answer: "What is every major asset doing right now?" Get a real-time "bingo board" of every power plant, including forward-looking bids, to see scarcity before it happens.

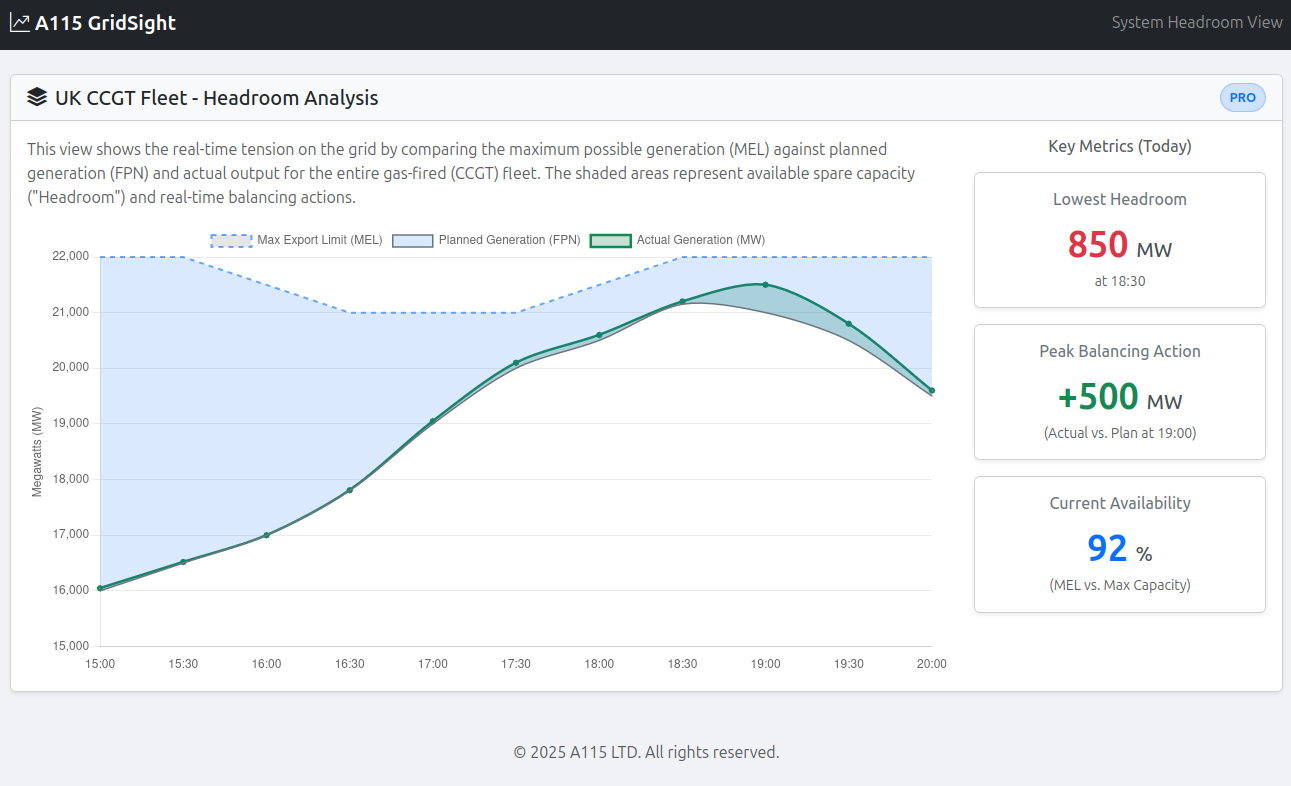

Visualise the Entire Grid in Real-Time

GridSight provides the macro and micro views you need. Track the real-time spare capacity of the entire CCGT fleet with the System Headroom View to gauge system tightness at a glance, or drill down into individual asset status on the Live Plant Status Board to understand the minute-by-minute dynamics.

We achieve this by engineering high-performance data pipelines that ingest and process information directly from primary industry sources like Elexon's BMRS and National Gas. The platform is built on a robust, scalable foundation of Python, Django, and TimescaleDB to deliver the speed and reliability your desk demands.

- Real-time generation output by fuel type.

- Forward-looking accepted bids and offers in the BM.

- Live status updates: generating, outage, or trip.

From Insight to High-Conviction Alpha

Information alone isn't an edge; intellectual rigour is. The Thesis Engine is our proprietary framework for moving beyond gut-feel and confirmation bias. It's a structured, evidence-based system designed to stress-test ideas, quantify conviction, and systematically manufacture robust, risk-managed trading theses.

Structured Ideation

Transform vague observations into specific, falsifiable, and quantifiable theses.

Adversarial Analysis

Systematically combat bias with a "Red Team / Blue Team" approach to challenge every assumption.

Quantitative Scoring

Translate qualitative debate into an objective, comparable conviction score for every idea.

Synthesis & Iteration

Use the analysis to build superior, higher-alpha strategies in a continuous learning loop.

The A115 Advantage: The GridSight Alpha Engine

Our true innovation is the fusion of these two systems. The GridSight Alpha Engine layers the Thesis Engine's rigorous workflow directly on top of GridSight's real-time intelligence. When the grid presents a high-signal event, our platform auto-generates a structured, stress-tested thesis—complete with historical analogues, real-time evidence, and a conviction score.

We turn market events into a live, ranked opportunity leaderboard, so you can focus your attention and capital on the best ideas first.

Built for the Modern Trading Desk

Our solutions are designed for the underserved majority: small-to-mid-sized trading funds, newly-formed desks at larger firms, and analysts who need best-in-class tools without the multi-year internal build. If you believe your edge comes from your market expertise, we build the software to amplify it.

Learn More About Our Consulting Services